📈 Options Strategy

Moby’s SPV employs refined options strategies to deliver sustainable rewards. Through a spread-based approach, it balances risk management and yield generation, capturing high returns via ultra-short-term (0–1 day) options trades. This adaptive approach is structured to maximize yield while keeping exposure under 3% while delivering yield benefits that surpass conventional DOVs.

Capital Efficiency

Allocates only 1–3% of deposited assets to collateralize positions, Moby requires small collateral for selling Call/Put spreads (15~20% of major CEX).

Dynamic Adjustments

Adjusts the capital allocation ratio within asset fraction, considering both market conditions and Greeks risk.

Strategic Approach

Executes short-term Call and Put spreads using the Iron Condor strategy.

Advanced Infrastructure

Utilizes the Synchronized Liquidity Engine (SLE) for optimal execution and capital deployment.

Future plans include introducing diverse vaults and strategies, such as interest-based options strategies focused on principal protection, enhanced returns, and vaults linked to LST/LRT and Real-World Assets.

Options Strategy

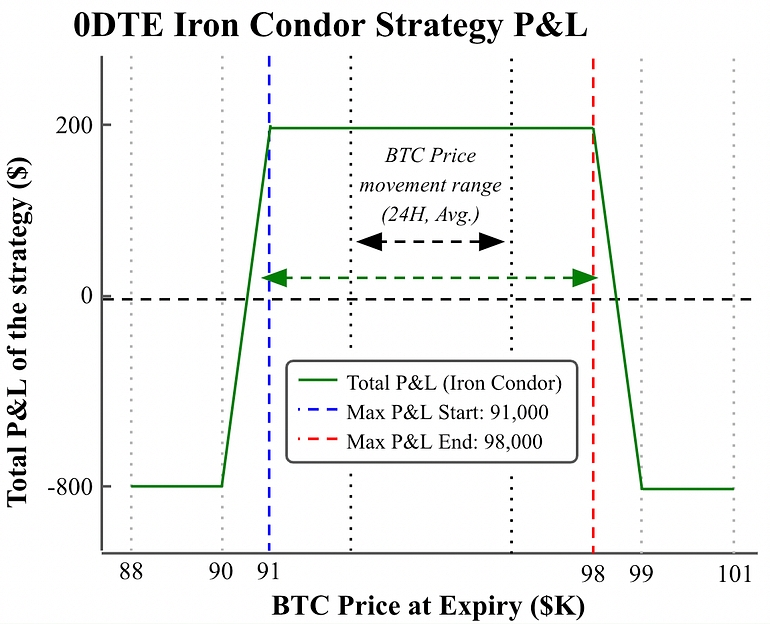

Iron Condor

The Iron Condor is a neutral options strategy optimized for low-volatility environments. It generates returns by collecting premiums within a predefined price range while limiting downside risk. Success depends on the underlying asset staying within the range, allowing sold options to expire worthless, and maximizing premiums.

Buy Put: Caps potential losses below the lower boundary.

Sell Call: Establishes the upper boundary of the price range.

Buy Call: Caps potential losses above the upper boundary.

Sell Put: Defines the lower boundary of the price range.

Broken Wing Iron Condor

The Broken Wing Iron Condor refines the traditional Iron Condor strategy by addressing two primary limitations [Learn More]:

Symmetrical Exposure

Equal contracts on both sides can lead to disproportionate losses during sharp market moves.

Premium Disparity

Imbalances in Call and Put premiums caused by differing implied volatilities.

Implementation Strategy

Moby’s BOV dynamically adjusts positions based on market indicators (25 Delta Skew & Butterfly Skew etc.) to optimize returns and mitigate risks:

Directional Adjustments

Allocate contracts to the Call or Put side depending on prevailing market sentiment, either for hedging risks (low risk/return) or securing more premiums (high risk/return).

Volatility Adjustments

Adjust position sizes in response to short-term volatility expectations, reducing exposure during high volatility and optimizing premium collection during stable periods.

These adjustments, informed by market conditions, allow the Iron Condor to dynamically align with changing environments, delivering enhanced risk-adjusted returns.

Last updated